The European stock market has recently experienced a significant surge, reaching its highest level in nearly two years. This remarkable ascent has been driven by multiple factors, including robust US employment data and China’s commitment to bolster domestic demand through fiscal policies. Let’s delve deeper into the intricacies of this market surge and its underlying implications.

1. Impact of Strong US Employment Data and Chinese Fiscal Policies

The unexpected strength in US employment data played a pivotal role in fueling the upward trajectory of the European stock market. The data not only exceeded market expectations but also signaled sustained demand within the labor market, providing investors with renewed confidence in economic stability.

Furthermore, China’s proactive approach to enhancing fiscal policies aimed at boosting domestic demand has contributed significantly to this surge. The commitment of the Chinese government has instilled optimism among investors, creating a ripple effect in global markets, including Europe.

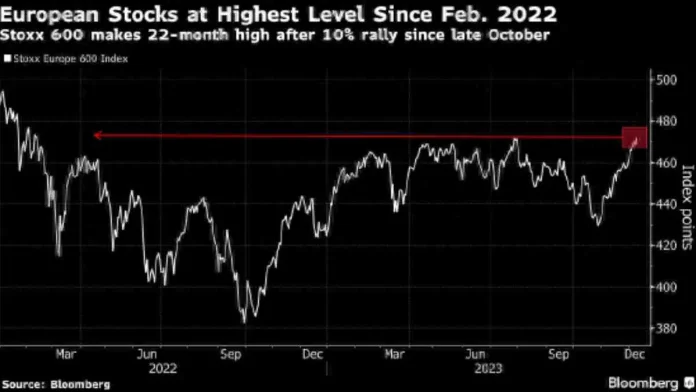

2. Analysis of the Europe Stoxx 600 Index Surge

The Europe Stoxx 600 Index witnessed a substantial increase, closing up by 0.7% during this surge. Notably, sectors such as luxury goods and tourism emerged as frontrunners, driving the overall gains in the market.

3. Notable Shifts in Individual Stocks

Amidst this market surge, certain individual stocks experienced remarkable shifts. Anglo-American shares plummeted by a staggering 19% following the announcement of significant cuts in commodity production. Conversely, Vivendi SE observed a surge in its stock value after the announcement of its inclusion in the CAC 40 index, positively impacting market dynamics.

4. Expert Insights on Market Dynamics

Richard Flynn, Managing Director of JXC UK, highlighted the significance of the employment report, emphasizing the robustness of the labor market demand. He pointed out that employment growth, coupled with a slowdown in inflation, will indicate to central bank officials that they are effectively managing their dual responsibilities.

5. Continued Market Momentum and Anticipated Rate Cut

The momentum gained in November has seamlessly transitioned into early December, with experts predicting an earlier-than-expected European interest rate cut. This anticipation has further bolstered market sentiment, contributing to the ongoing surge in the European stock market.

6. Conclusion

The recent surge in the European stock market can be attributed to a confluence of factors, including robust US employment data, China’s commitment to fiscal policies, and individual stock dynamics. This surge has not only boosted market sentiment but has also generated expectations for an earlier European interest rate cut, signifying positive economic prospects.

7. FAQs

The surge was primarily fueled by robust US employment data and China’s commitment to bolstering domestic demand through fiscal policies.

Anglo-American shares experienced a significant drop due to the announcement of substantial cuts in commodity production.

Vivendi SE witnessed a surge in its stock value following the announcement, positively influencing market dynamics.

Richard Flynn, the Managing Director of JXC UK, shared insights emphasizing the strength of the labor market demand.

Experts predict an earlier-than-expected European interest rate cut, further boosting market sentiment.